25+ what is dti for mortgage

Compare More Than Just Rates. Home loan payments including principal.

How To Lower Your Mortgage Debt To Income Ratio Dti Better Mortgage

Web As a rule of thumb you want to aim for a debt-to-income ratio of around 36 or less but no higher than 43.

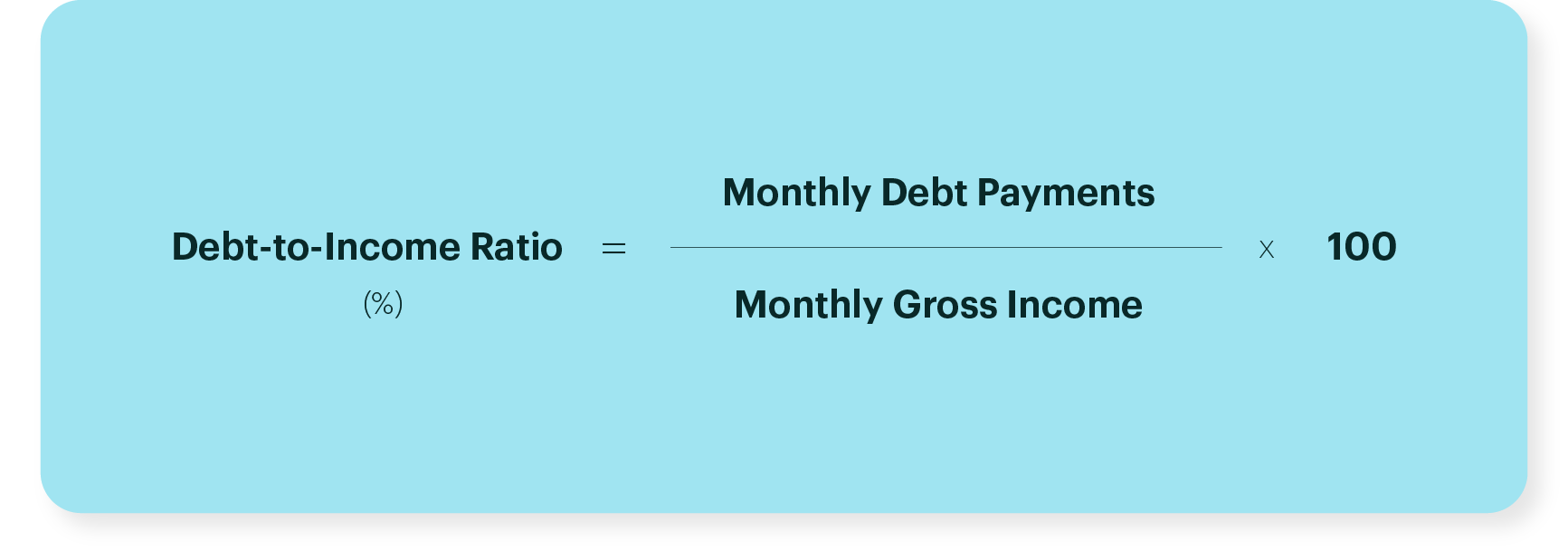

. Web A debt-to-income ratio DTI is a personal finance measure that compares the amount of debt you have to your overall income. Web DTI is calculated by adding up your monthly debt payments and dividing them by your gross pre-tax monthly income. Ad Use Our Comparison Site Find Out Which Mortgage Loan Lender Suits You The Best.

Ad Compare the Best Mortgage Rates From Top Ranked Lenders Apply Easily Online. Ad 5 Best House Loan Lenders Compared Reviewed. Compare Lenders And Find Out Which One Suits You Best.

Web A debt-to-income ratio of 20 means that 20 of your income is going toward debt payments. Web For illustration only. Heres how lenders typically view DTI.

On a 300000 fixed-rate 30-year mortgage the average rate is 641 as of Thursday if your credit score is in the 760-to-850 range according to. Debt-to-income ratio DTI Debt-to-income ratio DTI shows a persons monthly debt obligations as a percentage of their. Ad Learn More About Mortgage Preapproval.

Comparisons Trusted by 55000000. Two types of calculations are employed in mortgage. Web The choice of an ideal debt-to-income ratio for a mortgage is highly dependent on the lender type of loan and other mortgage requirements.

Ad Compare Home Financing Options Get Quotes. Your debt-to-income ratio DTI is all your monthly debt payments divided by your gross monthly income. Web Debt-to-income ratio DTI divides the total of all monthly debt payments by gross monthly income giving you a percentage.

Save Time Money. 130 minimum monthly payment. Web Front-end DTI.

Browse Information at NerdWallet. Also called a PITI ratio principal taxes interest and insurance this number reflects your total housing debt in relation to your monthly. To get the back-end ratio add up your other debts along with your housing expenses.

Web When you apply for a mortgage a lender considers your debt-to-income ratio or DTI as a critical evaluation point. Browse Information at NerdWallet. Web The debt-to-income DTI ratio measures the amount of income a person or organization generates in order to service a debt.

Dave Ramsey has a simple answer to the question of how big your housing budget should be. 2000 2000 8000 50. Web What is a debt-to-income ratio.

Web Loans for high DTI Simple definition. This includes cumulative debt payments so think credit card payments. A DTI of 43 is typically the highest.

Spend a Few Minutes Searching for Your Lowest Rates Save Money for Years. It Only Takes Minutes to See What You Qualify For. Compare More Than Just Rates.

Get Instantly Matched With Your Ideal Mortgage Loan Lender. Web To calculate his DTI add up his monthly debt and mortgage payments 1600 and divide it by his gross monthly income 5000 to get 032. This number is one way.

Find A Lender That Offers Great Service. Ad Check Official USDA Loan Requirements See If Youre Eligible for No PMI 0 Down More. Web On the one hand the math for calculating your DTI is simple we add up what your monthly debt will be once you have your new home such as student loans car.

Looking For a House Loan. Web Your front-end or household ratio would be 1800 7000 026 or 26. Ad Learn More About Mortgage Preapproval.

Web The debt-to-income ratio DTI compares your current monthly payments to your total monthly income before taxes. Multiply that by 100 to get a. Web When you apply for credit your lender may calculate your debt-to-income DTI ratio based on verified income and debt amounts and the result may differ from the one shown here.

Heres what you should know. Web Lets look at a real-world example. Web Gross monthly income.

Web 20 hours agoHeres what Ramsey says you can pay for a house. Check How Much Home Loan You Can Afford. Find A Lender That Offers Great Service.

Your DTI lets lenders know how much debt you. 36 DTI or lower. Lenders including issuers of.

Buying A House In 2023 25 Things You Need To Know Bhgre Homecity

Ecfr 12 Cfr 1240 33 Single Family Mortgage Exposures

Ecfr 12 Cfr 1240 33 Single Family Mortgage Exposures

Home Buyers Debt To Income Ratios Blow Out Hugely Interest Co Nz

Dylan Langei Mba Branch Manager Sr Loan Officer Evergreen Home Loans Nmls 3182 Linkedin

Debt To Income Ratio Calculator Nerdwallet

:max_bytes(150000):strip_icc()/GettyImages-463012867-572e2cbb5f9b58c34c8fa655.jpg)

What Is A Good Debt To Income Dti Ratio

What Is The Debt To Income Ratio For A Mortgage Freeandclear

Know About Debt To Income Ratio

Micaiah Anderson Branch Manager Producing Change Home Mortgage Linkedin

What Is Needed For A Mortgage Loan Application Quora

What Are Aaa Mortgage Loans Quora

Underwriting Training Mortgage Underwriting Training Calculating Income

:max_bytes(150000):strip_icc()/personal-finance-lrg-3-5bfc2b1f46e0fb0051bdccb6.jpg)

Debt To Income Dti Ratio What S Good And How To Calculate It

House Poor Common Mistakes You Should Learn To Avoid Now Savoteur

Debt To Income Ratio Explained

Liberty Home Mortgage Wv Ripley Wv